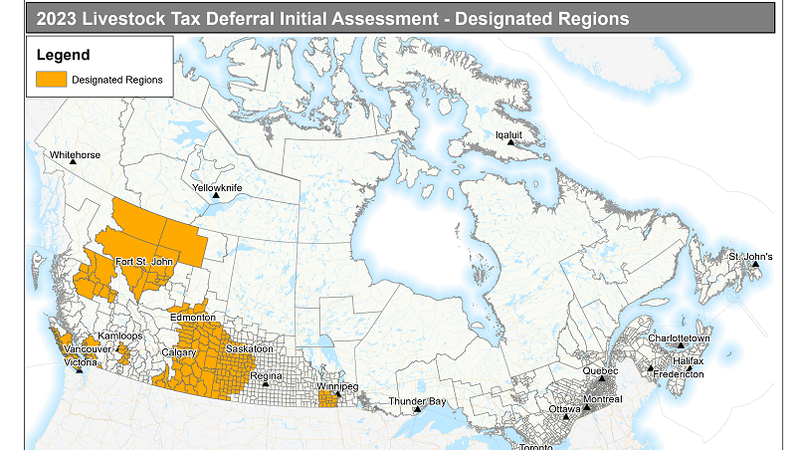

Livestock tax deferral for designated area in Western Canada

The federal government has announced it’s first list of regions in British Columbia, Alberta, Saskatchewan, and Manitoba where Livestock Tax Deferral has been authorized for 2023.

The provision allows livestock producers who are forced to sell all or part of their breeding herd due to drought or excess moisture to defer a portion of their income from sales until the following tax year.

The income can be at least partially offset by the cost of reacquiring breeding animals, thus reducing the tax burden associated with the original sale.

A preliminary list is usually completed in the early fall but making the announcement now helps producers who are making difficult herd management decisions.