Liberals promise national flood insurance, disaster EI benefits

The federal Liberals unveiled promises Wednesday to help homeowners prepare for damage from climate change with low-cost national flood insurance and zero-interest loans for green home renovations.

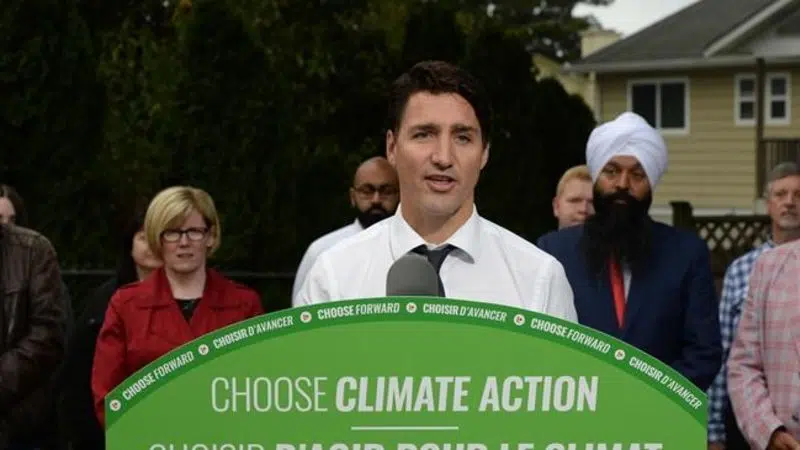

Leader Justin Trudeau was in the yard of a home in Delta, B.C., in greater Vancouver, to announce additional climate-change-related measures.

“We recognize that people are facing increased flooding because of the effects of extreme weather events and increased impacts of climate change,” Trudeau said.

Trudeau said helping people figure out whether or where to rebuild after a flood is a difficult conversation, so his mitigation plans will start with $150 million to complete flood mapping in every province and territory, to identify land that’s at greater risk of inundation.