Earlier or Later? Deciding When to Start Canada Pension Plan Retirement Benefits

“The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of Pattison Media and this site.”

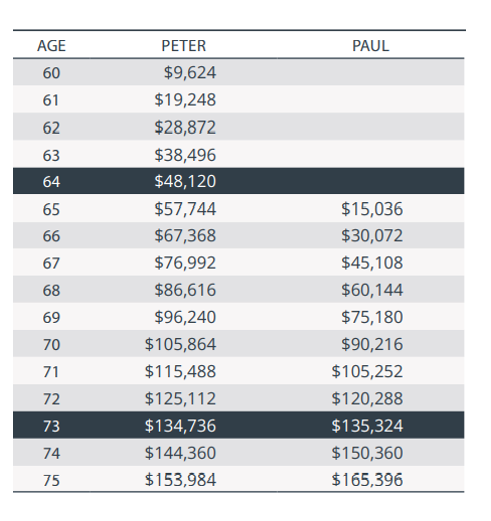

Many individuals approaching retirement wonder if there is an optimal age to begin taking their Canada Pension Plan retirement pension benefits (CPP). The question often arises because CPP is calculated based upon the age at which an individual starts to receive monthly payments. Though the standard age to start CPP is 65, Canadians can start receiving CPP as early as 60 or as late as 70.

The standard CPP entitlement at age 65 is reduced by 7.2% for every year (0.6% per month) taken before 65 and is increased by 8.4% for every year (0.7% per month) taken after 65.