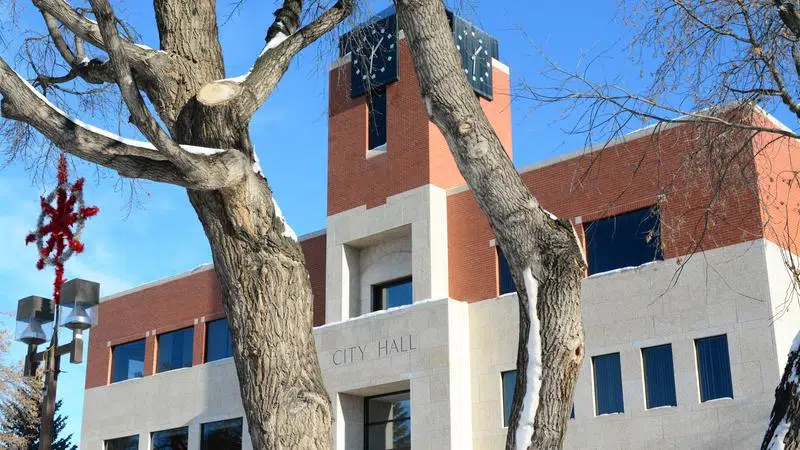

Prince Albert considers tax increase for businesses assessed at over $5 million

The Prince Albert Chamber of Commerce isn’t happy with a proposed tax increase for big businesses being considered by city council.

While the increase would only affect 16 of the largest commercial properties in the city, Chamber CEO Elise Hildebrandt told paNOW the trickledown effect will be significant.

“People think ‘Oh well it’s all OK because it’s corporate that’s paying it,’” she said. “But we the small businesses rent from corporate, so we’ll still end up paying it.”

City administration is recommending the tax increase to cover lost revenues from property assessment appeals and resulting tax adjustments. Twelve of the city’s largest businesses are currently appealing their property assessments in an effort to get partial refunds on their taxes.