Tax Planning Checklist

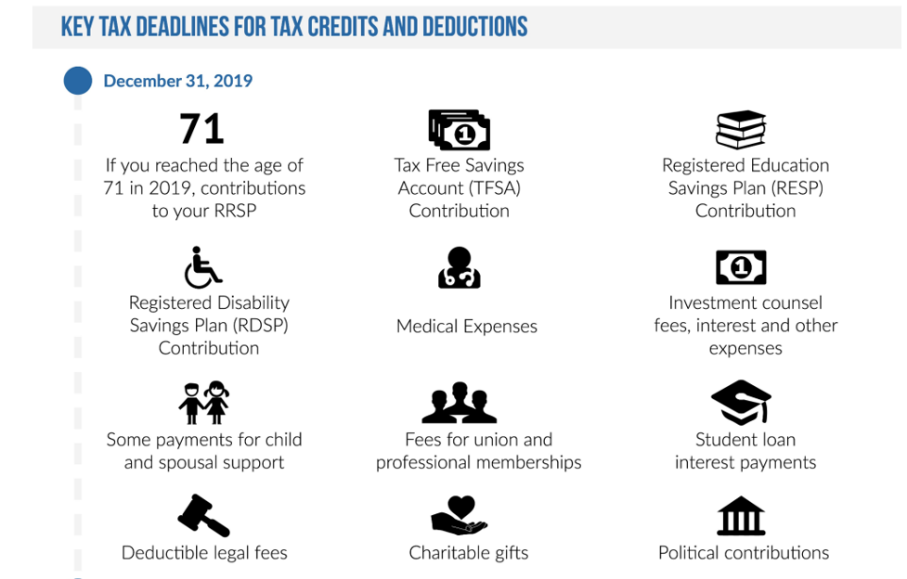

Can you believe 2019 is nearly over and Tax Season is fast approaching? That’s why we have put together some year end tax tips that can help you with your TFSA, RESP, RDSP and RSP.

SEE GRAPHIC BELOW

Family tax incentive programs include Canada Child Benefit, Income splitting, RESP and RDSP contributions which are great savings tools for a child’s education. The newer incentive program is the Registered Disability Savings Plan (RDSP). It is a savings plan for parents and others designed to create financial security for a person who is eligible for the disability tax credit (DTC). The Canada disability savings grant will pay matching grants of 300%, 200% or 100% depending on the beneficiary’s adjusted family net income and amount contributed. The income-tested Canada disability savings bond is paid directly to the RDSP by the Canadian government to low- income Canadians with disabilities. Before December 31 of the year you turn 49 years old, you can carry forward up to 10 years of unused grant and bond entitlements to future years, if you met the eligibility requirements during the carry forward years.

Managing investments include contributing to TFSA, donations to charities, and timing of the sale and purchase of investments. A Tax-Free Savings Account (TFSA) can help you put money away if you are able. The 2019 TFSA Limit is $6,000. You can also contribute more (up to $63,500) if you are 28 or older and haven’t made any previous TFSA contributions. In supporting your favorite charity by year-end, you will realize tax savings. If you donate eligible securities or mutual funds, capital gains tax does not apply. You will then receive a tax receipt for their full market value and the charity gets the full value of the securities.