Wisconsin governor vetoes tax plan; early showdown with GOP

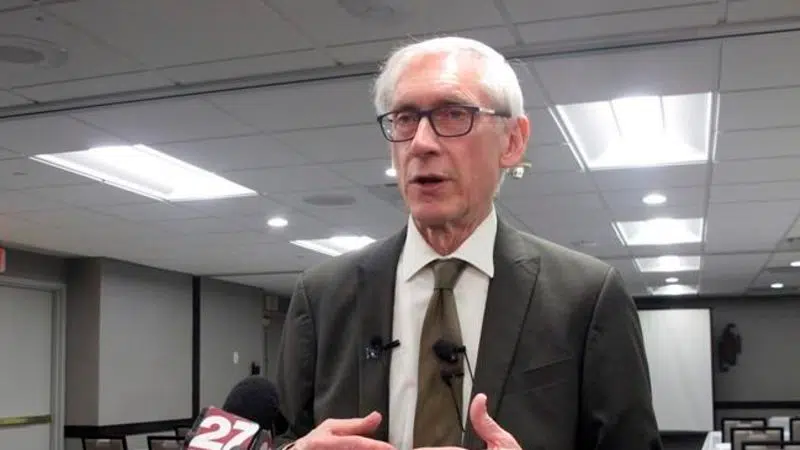

MADISON, Wis. — Wisconsin Gov. Tony Evers vetoed a GOP income tax cut bill Wednesday in an early showdown with legislative Republicans who had moved to weaken the Democrat’s powers just weeks before he took office.

Republicans rushed to pass the bill, the first they introduced this year, before Evers could introduce his own income tax plan next week. Democrats quickly labeled the move a stunt.

The GOP Legislature lacks the votes to override the veto.