Kinder Morgan CEO says there’s a ‘seller’s market’ for remaining Canadian assets

CALGARY — There’s a “seller’s market” for attractive assets like those held by its Canadian subsidiary, the CEO of Kinder Morgan Inc. said on a conference call Wednesday to discuss third-quarter results.

The company is working on a strategic plan that could include a sale or sale of assets for its Canadian arm even though it likely won’t distribute funds from the sale of its major asset, the Trans Mountain pipeline system, until January, said Steve Kean, who is also CEO of Kinder Morgan Canada Ltd.

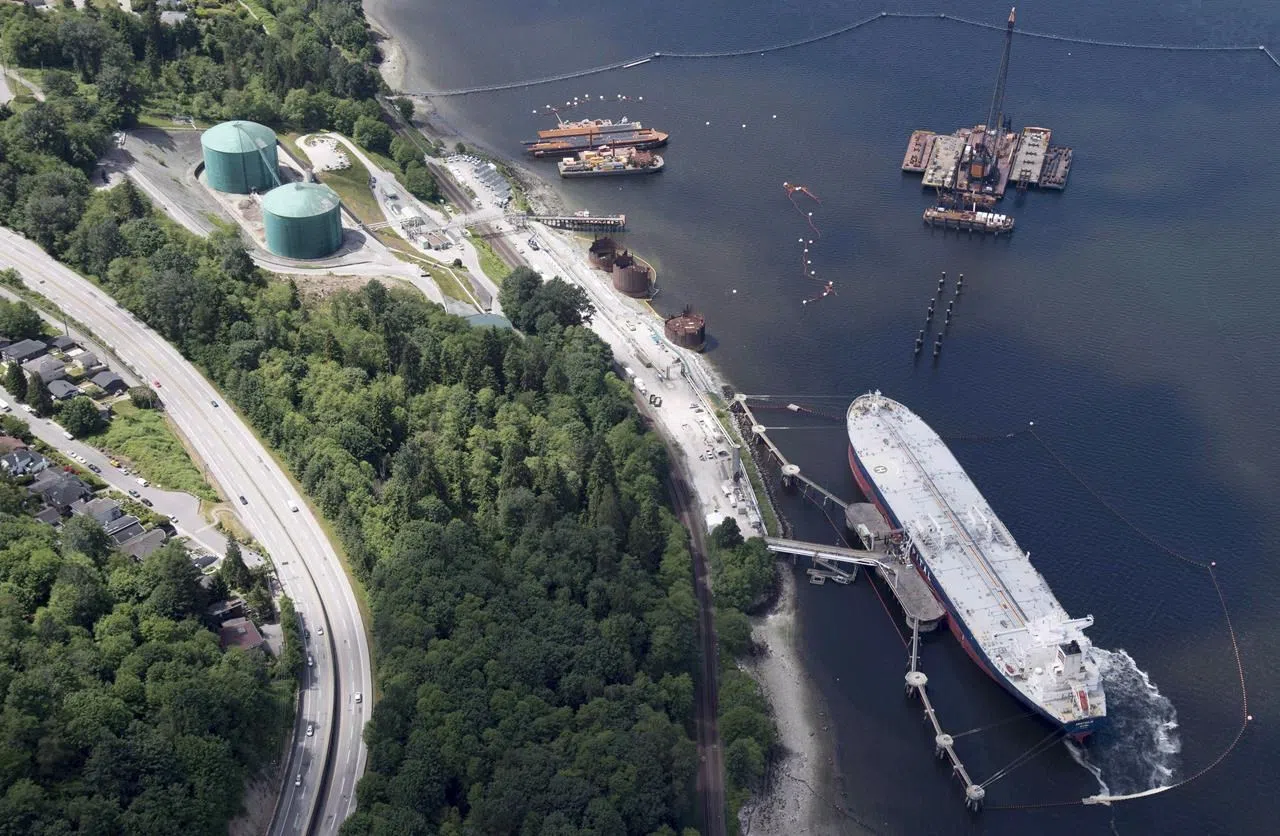

“On the KML assets, we think they’re great assets,” he said, listing crude tank storage and rail terminals in Alberta, the Vancouver Wharves Terminal and the Cochin Pipeline system which transports condensate from the United States to the Edmonton area.

“We think that asset packages like this are rare, anywhere, but they’re rare to come to market and they’re rare to come to market in Western Canada, so we do think that it tends to be a bit of a seller’s market for these assets.”