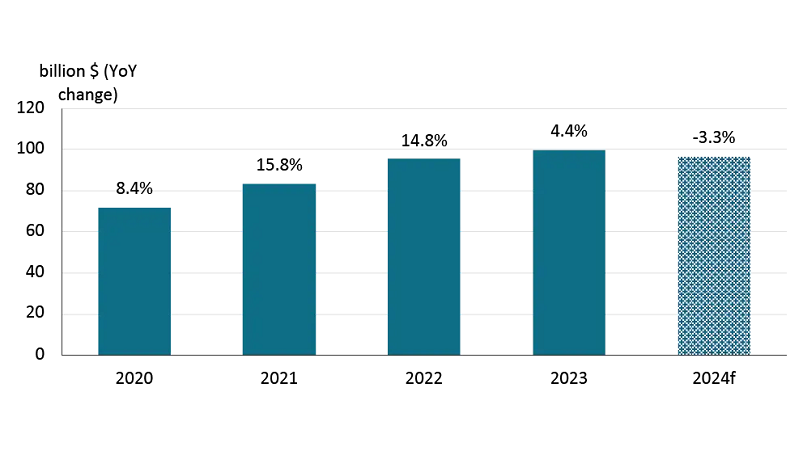

Farmland values increase despite lower revenues

The mid-year value of Canadian farmland went up despite higher interest rates and less money in farmers’ pockets.

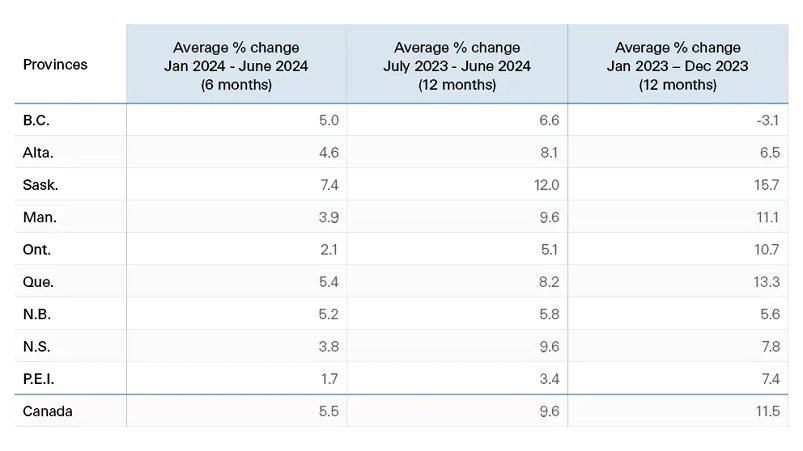

Farm Credit Canada said the price of farmland rose by an average of 5.5 per cent in the first half of 2024. Over the year from July 2023 to June 2024, there was a 9.6 per cent increase, representing a slowdown compared to the previous year, likely the result of lower commodity prices and elevated borrowing costs.

For the second consecutive year, Saskatchewan recorded the highest average six-month increases in the country, at 7.4 per cent. The rates in Quebec, New Brunswick, British Columbia, and Alberta all settled in the 5.4 per cent range, 5.2 per cent, 5.0 per cent, and 4.6 per cent, respectively. Manitoba recorded a growth rate of 3.9 per cent, closely followed by Nova Scotia at 3.8 per cent. Ontario recorded a lower increase at 2.1 per cent, with Prince Edward Island concluding the list at 1.7 per cent.

(submitted photo/Farm Credit Canada)

(submitted photo/Farm Credit Canada)