B.C. finance minister says speculation tax brings balance to housing crisis

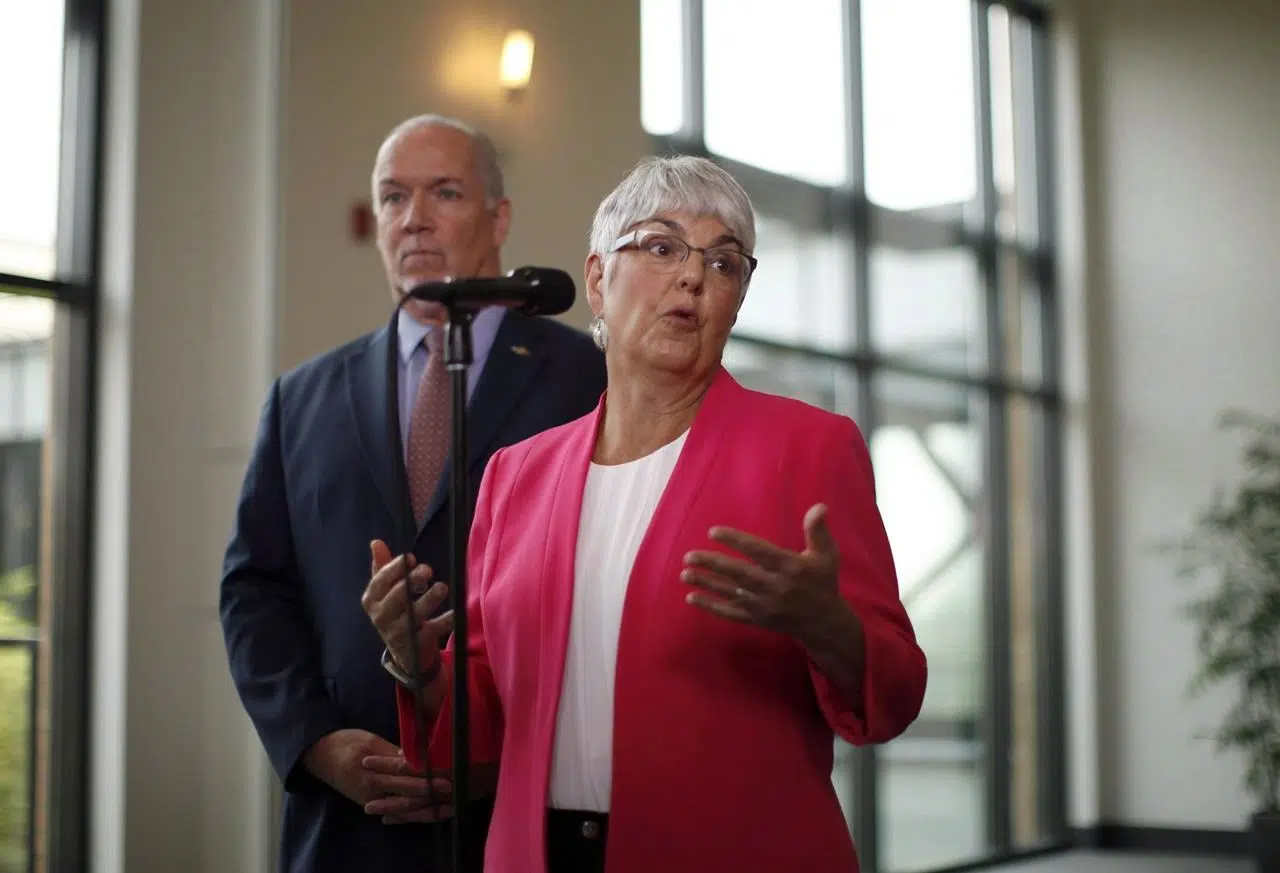

VICTORIA — British Columbia’s proposed speculation and vacancy tax is aimed at cooling an overheated real estate market and convincing owners of vacant homes in some urban areas to either sell or rent their properties, says Finance Minister Carole James.

The legislation introduced Tuesday would impose a tax of either 0.5 per cent, one per cent or two per cent on the assessed value of a vacant property in the 2019 taxation year and onwards. For the 2018 tax year, the government will levy 0.5 per cent for all properties subject to the tax.

The highest rate of two per cent would be applied to foreign owners and so-called satellite families, or those who don’t report the majority of their income on Canadian tax returns, James said.

Canadian citizens and permanent residents who don’t live in the province would pay one per cent on their homes assessed value.